From Theory to WTF: My First Time Using Stablecoins

Until stablecoin feels as easy as Venmo, mass adoption is still a dream.

I know I’ve been sort of singing the praises of Circle and stablecoins. And yes, this idea of a “stablecoin sandwich” makes so much sense -- on paper. You fiat-on-ramp onto the chain, convert into coins, send instantly to the recipient, they off-ramp to fiat -- boom, done in minutes, right?

In theory, yes.

Now, I like to think I’m a moderately tech-savvy person living in San Francisco. In the hierarchy of tech, being on the business side doesn’t exactly put me at the top of the Silicon Valley totem pole. Still, I figured I could at least send a simple crypto transfer.

I was wrong.

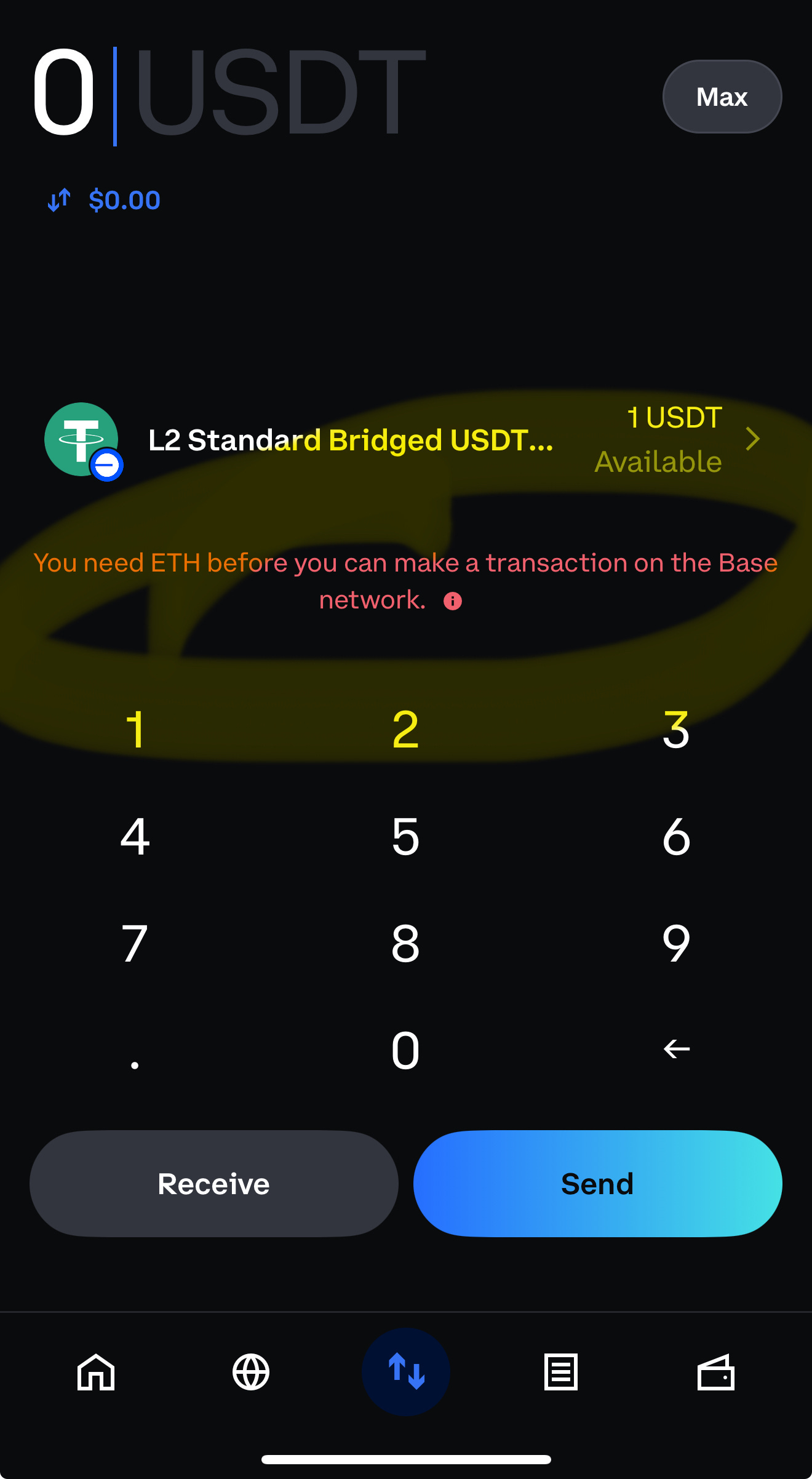

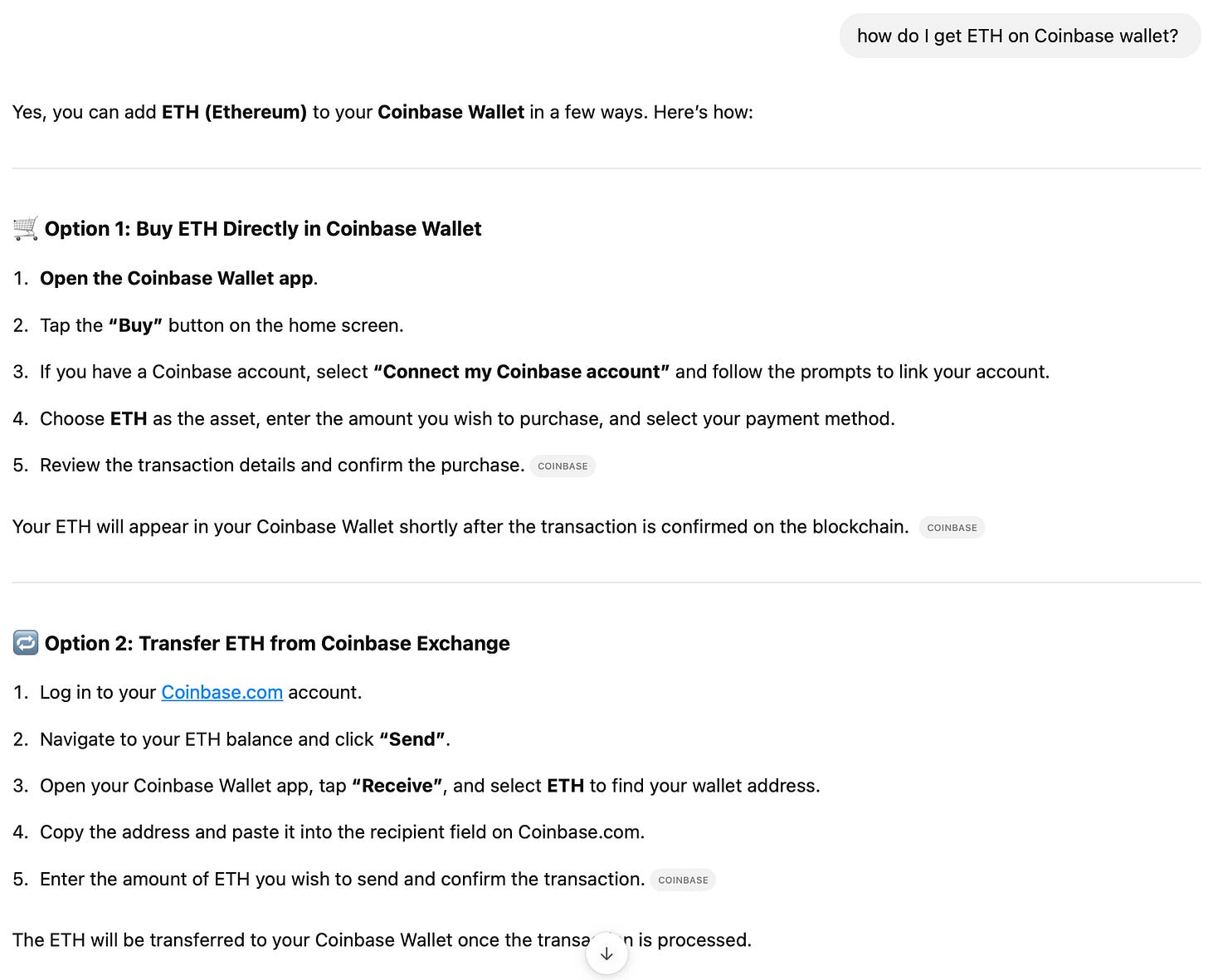

I had zero practical experience with crypto wallets or blockchain and decided to test the waters by sending a friend some USDT. What actually happened? It took me 75 minutes -- yes, 75 -- and I ended up sending a tiny fraction of Ethereum instead. At that point, anything leaving my Coinbase Wallet felt like a win. I had no idea how much I spent in fees or which payment method got charged. It was a mess.

(I had to enlist ChatGPT for help -- told you I’m moderately tech-savvy :))

But it gave me some thoughts.

First: we’re nowhere close to making crypto usable for the average consumer -- whether as a wallet or a payment instrument. I tried to rationalize it: maybe this is the “Snapchat moment,” where only the cool kids get it. But fintech isn’t about being cool. It’s about scale. Or better being cool and scalable! It’s about changing behavior. And if something is this goddamn hard to use, it’s not changing anyone’s behavior.

Second: who is using stablecoins and crypto wallets? Follow the money. The top remittance corridors are US-Mexico, US-India, US-Philippines, US-China, and US-Vietnam -- money flowing out of the U.S. to developing economies. Maybe folks in those countries are motivated enough to jump through the hoops to get extra USDs. But do we seriously expect a 70-year-old grandmother in the Philippines (since China blocks crypto anyways) to navigate MetaMask just to receive a payment? Or is she just going to walk to the nearest Western Union and pick up cash from a friendly clerk?

Sure, there are edge cases -- like refugees receiving USDC via Stellar during the war in Ukraine. But if the business model relies on crisis-driven adoption, that’s not product-market fit. That’s survival mode. Pretty much like how COVID ushered the U.S. into the world of contactless payments -- not because of convenience, but because we had no choice. It worked as a forcing function, but you can’t build a lasting business betting on emergencies.

Right now, we’ve got base chains, L2s, wallets, exchanges -- and multiple providers at every layer. Users are essentially being asked to “choose their own adventure” in a system that probably makes no sense to them.

I don’t see stablecoins – even the most “stable” kind – reaching meaningful adoption until the user experience is drastically improved. Most consumers don’t care about the underlying tech – blockchains, protocols, tokenization, gas fees. They just want something that works, seamlessly and intuitively.

Right now, the landscape is fragmented, filled with jargon, and built on infrastructure that simply wasn’t designed with everyday users in mind. It’s not just hard to use – it’s hard to even know where to begin. Crypto already carries the reputation of being speculative and anarchic – that alone is a hurdle. The added complexity and poor user experience only deepen the trust gap.

That said, I do see how stablecoins improve cross-border transaction speed. And I see the business model: platforms like Coinbase and liquidity providers can skim value by arbitraging across time and geography – just like banks do. But the real promise may lie in institutional use cases, not retail ones. At least not with the current user experience. If the industry wants to move forward, it needs to get out of the hype cycle, prioritize usability, and operate within a stable, reasonable regulatory framework.

Stripe made credit card acceptance seamless with seven lines of code. Crypto might be a much more complex space, but the mission is largely the same: simplify, streamline, scale.

I feel your pain. I am building smth new that tackles exactly those problems. If you are curious to learn more, I am happy to provide you with an early access to try it out.

That's my LinkedIn: https://www.linkedin.com/in/steven-figura/

Feel free to reach out.

Best,

Steven